Apr 11, 2024

China to Eliminate Foreign Investment Restrictions in Cloud and Other Telecom Services

by Richard Ma, Joanna Jiang, and Dimitri Phillips

On 10 April 2024, China's Ministry of Industry and Information Technology (“MIIT”) issued the Notice on Carrying Out the Pilot Work of Expanding Opening-Up to Foreign Investment in Value-Added Telecom Services (“Notice”), which heralds the elimination of foreign investment restrictions on cloud services and other value-added telecom services (“VATS”) in pilot areas. Subject to implementation by the pilot areas, foreign parties will be allowed to invest or engage 100% in businesses based in the pilot areas and offering the specified VATS. This Notice is a significant positive development for China’s telecom markets, especially for foreign cloud service providers. The key points of the Notice are summarized below.

Which VATS restrictions will be eliminated?

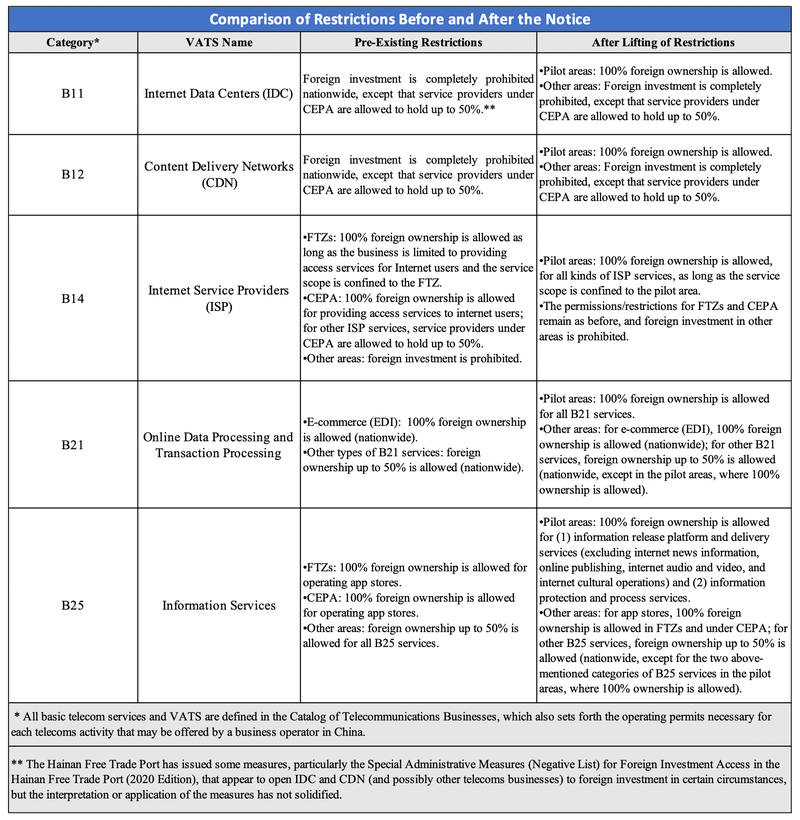

The Notice states that the pilot areas will be free from restrictions on foreign ownership in the following categories of VATS: Internet data centers (IDC),[1] content delivery networks (CDN), Internet service providers (ISP), online data processing and transaction processing, information services[2] (including information release platform and delivery services but excluding Internet news information, online publishing, Internet audio and video, and Internet cultural operations), and information protection and processing services.

As can be seen in the below table, the pre-existing restrictions on foreign investment for these VATS are several and varied, including based on whether the services are offered from Free Trade Zones (“FTZs”), on whether they are offered by providers qualified under the Mainland and Hong Kong Closer Economic Partnership Arrangement (“CEPA”), and on which subcategories of services are offered. The Notice heralds not only the further opening-up of several categories or subcategories, but also to some extent the simplification of the overall framework of restrictions, although foreign investors will still have to consider factors such as the location and subcategory of services in which they wish to invest.

Notably, in the B1 category, the only subcategory whose restrictions will not be eliminated under the Notice is B13, domestic Internet virtual private network services (IP-VPN). In other words, foreign investment in the domestic IP-VPN services is still prohibited, except for up to 50% foreign investment in such businesses in FTZs or under CEPA.

In the B2 category, because B22 (domestic multi-party communication services), B23 (storage and forwarding services), and B24 (call center services)[3] are already free from foreign investment restrictions nationwide, only the following restrictions will remain in the pilot areas (also remaining elsewhere, for all foreign investors, alongside other restrictions elsewhere):

- 50% cap on foreign ownership for the following subcategories B25: information search services, information community platform services, and information instant interaction services.

- 50% cap on foreign ownership for B26, i.e., encoding and protocol conversion services.

Which are the pilot areas?

Four pilot areas are currently set to eliminate the restrictions summarized above: parts of Beijing, Shanghai, Shenzhen, and Hainan – specifically:

- Beijing Service Industry Expansion and Opening-up Comprehensive Demonstration Zone

- Shanghai Free Trade Zone Lingang New Area and Socialist Modernization Leading Area

- Hainan Free Trade Port

- Shenzhen Socialist Pioneer Special Cooperative Zone

Other areas may, at their discretion (or direction from higher-level government), seek to open their VATS markets according to the Notice, and they may do so upon approval by the MIIT.

What are the requirements for operating free from the restrictions?

Under the Notice, subject to its implementation by the pilot areas, for a business to be free of the foreign investment restrictions as summarized above, it must satisfy the following requirements:

- The business must apply to the central MIIT for approval, with the detailed process still to be clarified by the MIIT.

- The business’s registered address and service facilities must all be physically located within the pilot area. For example, for a foreign-invested business to obtain and use a B12 license (in a pilot area), all the space, servers, and other facilities (whether rented, purchased, etc.) must be located within the pilot area.

- If the business is for ISP services, not only the registered address and facilities, but also the service offering, must be physically located in the pilot area, and the Internet access services must be provided through devices of basic telecom enterprises. In essence, while a wholly foreign-owned enterprise will be able to offer ISP services, at this stage, its clientele will be limited to the denizens of the pilot area in which the business is registered (and obtains MIIT approval).

Takeaways

Since recently, China appears to be doubling down on its opening-up of telecom sectors that have long been of interest to foreign investors. The Notice, while of immediate practical importance in itself, is a more significant sign of the trend of opening-up, which is thus likely to continue and expand. At this stage, foreign parties have in essence been given a green light to invest in and run businesses offering numerous coveted telecoms services to customers/users across all of China (although with the facilities limited in the pilot areas), except in the case of ISP services, which still have geographic limitations. Subsequent stages may involve more kinds of services being opened to foreign investors or an expansion of the geographic scope of the opening-up, or both. Further simplifications of the licensing and other processes for setting up foreign-invested telecoms enterprises may also follow. We will continue to monitor and report on developments in all these respects.

Footnotes

[1] This category also includes Internet resource collaborative (“IRC”) services, such as data storage, Internet application development services, Internet application deployment and operation management services, collaborative sharing platforms and other services offered via equipment and resources established via data centers; all the above require a sub-category of an IDC permit called an IRC license.

[2] This category, also known as Internet content provider (“ICP”) services, comprises: (i) information release platform and delivery services, which usually refer to online services provided by a platform disseminating content in the form of text, video, or applications; (ii) information search services, which usually refer to online services provided by search engines; (iii) information community platform services, which usually refer to online services provided by platforms that allow users to exchange information; (iv) information instant interaction services, which usually refer to online services that, through a service provider’s product, allow users to exchange information instantly; and (v) information protection and processing services, which usually refer to online anti-virus functions and information protection services.

[3] In practice, the MIIT is very prudent about granting any call center services licenses, and only a few foreign-invested telecoms enterprises have obtained such licenses during the past years, notwithstanding the principle that foreign investors are allowed to hold 100% ownership of call center services.

Newsletter

Subscribe to our newsletter.

Related Services

Related Lawyers

Apr 19, 2025

DaHui Advises on Major Bio-Ethanol Deal in Vietnam, Combined Entity Expected to List on NASDAQ

Read Article