Jan 3, 2022

China Releases Draft Regulations on Overseas IPOs and Securities Offerings

On 24 December 2021, the China Securities Regulatory Commission (“CSRC”) released two new regulations in draft form: the Provisions of the State Council on the Administration of Overseas Securities Offerings and Listings by Domestic Companies (for Public Comments) (“Provisions”) and the Administrative Measures for the Filing of Overseas Securities Offerings and Listings by Domestic Companies (for Public Comments) (“Measures”, and with the Provisions, collectively, the “New Rules”); the public comment period is set to end on 23 January 2022. The New Rules would establish new requirements and procedures, essentially “filings”, for listings on overseas securities exchanges and for offerings of securities overseas, in either case by companies incorporated in Mainland China (“Direct Listing/Offering”) or by so-called “red-chip” companies, i.e., offshore entities whose assets and management are primarily in or of Mainland China (“Indirect Listing/Offering”). Rules of this kind have been expected by the market for months, but these draft rules, on their face, are less restrictive than anticipated. This Newsletter provides a summary of key points from the New Rules and potential open questions and implications.

Who and What Is Subject to the New Rules?

The New Rules would apply to a relatively wide range of parties and activities in overseas securities listings and offerings substantially connected with Mainland China, although subject to slightly different filing requirements and procedures.

In addition to all Direct Listings/Offerings, most or all kinds of indirect listings and offerings substantially connected with Mainland China could also be covered by the New Rules, as Article 3 of the Measures provides that the determination would be made “on a substance over form basis”. At least if the following conditions are met, the listing or offering will be deemed an Indirect Listing/Offering:

- the total assets, net assets, revenues or profits of the domestic operating entity of the issuer in the most recent accounting year account for more than 50% of the corresponding figure in the issuer’s audited consolidated financial statements for the same period; and

- the senior managers in charge of business operations and management of the issuer are mostly Chinese citizens or have domicile in China, and its main places of business are located in China or main business activities are conducted in China.

Broadly interpreted, most if not all methods and ends of Direct and Indirect Listings/Offerings would be subject to the New Rules, including reverse mergers, SPAC deals, backdoor listings, etc. Both new listings, whether the first or a follow-on (or dual) listing, and re-financings would be covered, though subject to different filing requirements and procedures, as well as issuances of overseas securities to purchase assets.

Finally, Article 16 of the Measures provides that overseas securities companies providing sponsorship or serving as lead underwriters for Direct or Indirect Listings/Offerings must satisfy certain filings requirements.

Restrictions, Requirements and Procedures

While capital markets have anticipated broader restrictions, the New Rules expressly prohibit only a few categories of Direct and Indirect Listings/Offerings, and ostensibly place only “filing” – rather than approval – requirements on the remainder.

Specifically, Article 7 of the Provisions prohibits Direct and Indirect Listings/Offerings in the following circumstances (plus the typical catch-all “or other circumstances as prescribed by the State Council”):

- if the intended listing or offering falls under specific clauses in national laws and regulations and relevant provisions prohibiting such financing activities;

- if the intended securities listing or offering overseas may constitute a threat to or endanger national security;

- if there are material ownership disputes over equity, major assets, core technology, etc.;

- if, in the last three years, the domestic company or its controlling shareholders or actual controllers have committed corruption, bribery, embezzlement, misappropriation of property or other criminal offenses disruptive to the order of the socialist market economy, or are currently under judicial investigation for suspicion of criminal offenses or under investigation for suspicion of major violations; or

- if, in the last three years, board directors, supervisors or senior executives have been subject to administrative punishments for severe violations, or are currently under judicial investigation for suspicion of criminal offenses or under investigation for suspicion of major violations.

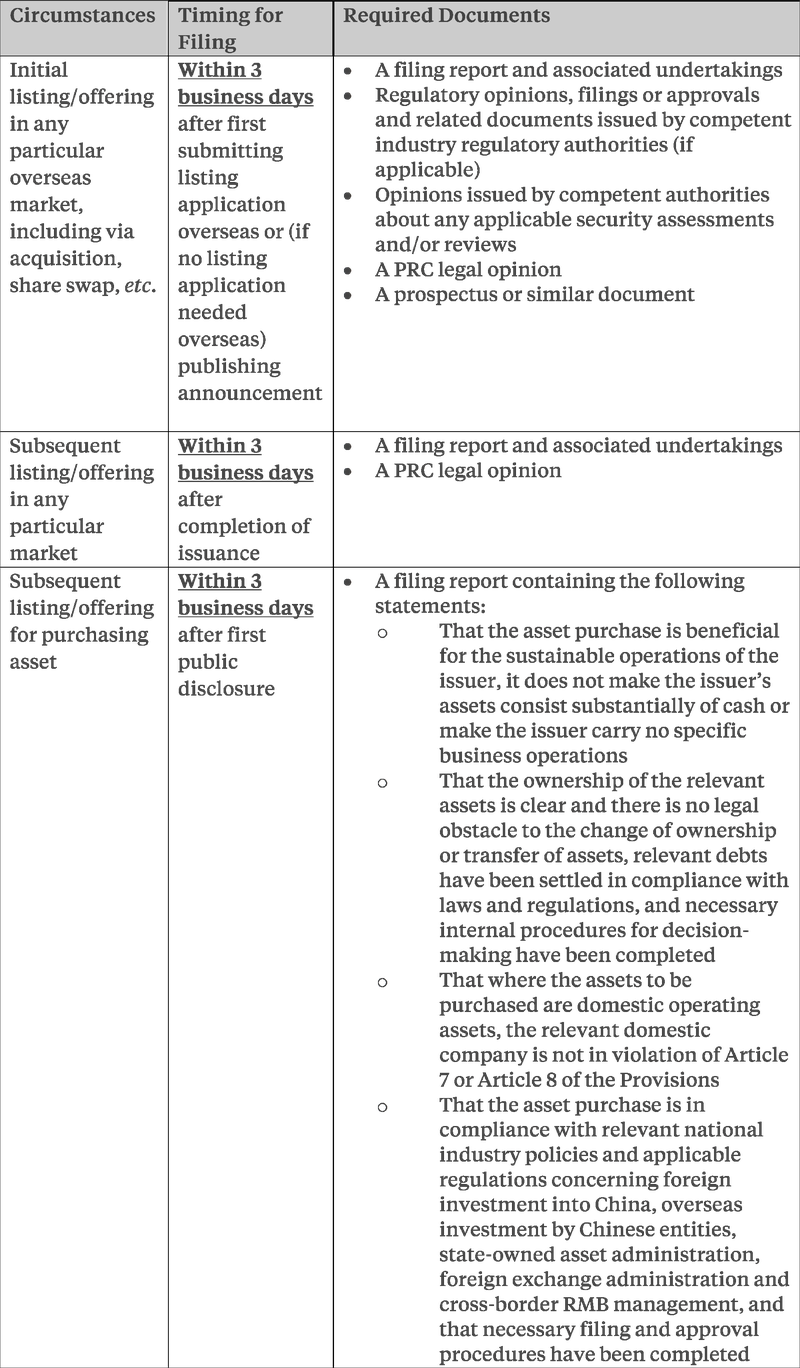

In other circumstances, the relevant issuer (or, if it is an offshore entity, a designated onshore operating entity) would be required to make a filing with the CSRC according to the kind of listing or offering undertaken as follows:

The New Rules provide that the CSRC will, within 20 working days after receiving all the requisite filing documents, issue a “filing notice” (and publish information on its website), though the time limit would be extended not only for time needed for filers to supplement omitted or incomplete documents but also for any time the CSRC needs to consult with other PRC authorities. Moreover, although the above are characterized as constituting a “filing” requirement, the New Rules include several mechanisms whereby regulators may actively impose on Direct and Indirect Listings/Offerings. For example, the CSRC may “impose a postponement or termination” of one of the listings or offerings prohibited by Article 7 of the Provisions.

In extreme cases, the competent PRC regulatory authorities may even require divestiture of relevant business or assets of issuers in order to mitigate or avoid impact, from Direct and Indirect Listings/Offerings, on national security. Notably, the New Rules provide that not only the CSRC but also other regulatory authorities under the State Council may order divestiture. It is unclear whether this provision would actually grant this power to some authorities that previously did not have it, e.g., whether the Cyberspace Administration of China would be (formally) empowered to order divesture of Chinese companies that are considered critical information infrastructure operators.

As for overseas securities companies providing sponsorship or serving as lead underwriters for Direct or Indirect Listings/Offerings, they would be required to make a filing both within 10 working days of being engaged and no later than January 31 of each year.

Penalties

In addition to the potential impositions of the competent regulatory authorities on an intended Direct or Indirect Listing/Offering, the New Rules also include a set of administrative penalties that the CSRC alone can enforce, e.g., warning to the relevant parties involved, fines on relevant parties, confiscation of funds raised and suspension of operations.

Takeaways

On the one hand, the New Rules could be viewed as a welcome clarification and unification of the regulatory framework for listing and offering securities overseas substantially connected with Mainland China companies, if and when the New Rules are officially issued. On the other hand, in effect – including possibly even while in draft form – the New Rules represent additional hurdles for such companies to list overseas, albeit not as burdensome as markets may have anticipated. This two-edged nature is exemplified in the case of highly regulated industries (e.g., many subsectors of telecoms and finance) and the corporate structures often used to operate in them (i.e., so-called “Variable Interest Entities”, a.k.a. “VIEs”): while the New Rules may reflect a further liberalization of the CSRC’s attitude towards such cases, with a CSRC official even stating in a press release that VIEs complying with PRC laws would be eligible to make the filings for overseas listings and offerings, the specific filings required may problematize the process.

In addition, many particulars about the requirements and procedures remain unclear, such as details about the opinions to be issued by industry regulators (if needed) and law firms, details about the filing requirements imposed on overseas underwriters, and (if read together with certain provisions of the Special Administrative Measures (Negative List) for Foreign Investment Access (2021 Edition), issued a few days after the New Rules) whether overseas listings and offerings would be allowed in some industry sectors in which foreign investments were previously prohibited. Such issues may be cleared up in later rounds of drafts or may have to await clarification in other measures or enforcement practices. For now, companies that are carrying out (or considering) Direct or Indirect Listings/Offerings should carefully review the New Rules and confer with PRC attorneys and possibly regulators to ensure their plans are not affected, even if only indirectly, by the (draft or potentially soon-to-be-issued) New Rules.

Newsletter

Subscribe to our newsletter.

Related Services

Related Lawyers

Apr 19, 2025

DaHui Advises on Major Bio-Ethanol Deal in Vietnam, Combined Entity Expected to List on NASDAQ

Read Article