Mar 3, 2023

China Issues New Measures for Overseas Securities Offerings and Listings by PRC Companies

On 17 February 2023, the China Securities Regulatory Commission (“CSRC”) released the Trial Administrative Measures of Overseas Securities Offerings and Listings by Domestic Companies, as well as a series of supporting guidelines (together, “Trial Measures”), which will take effect on 31 March 2023. The Trial Measures may signal a new era for a filing-based administration of overseas securities offerings and listings by PRC domestic companies. This news alert briefly sets out certain key aspects of the Trial Measures.

Highlights of Trial Measures

A few of the key highlights of the Trial Measures are summarized as follows:

- The Trial Measures envision a filing-based administration for all kinds of overseas securities offerings and listings by domestic companies (including the issuance of new securities, overseas listings of domestic companies that are achieved through the acquisition of assets, listings involved in restructurings, SPAC listings, etc.), and seek to oust and replace China’s previous examination and approval system while enhancing ongoing supervision in parallel.

- The Trial Measures also formally integrate “red chip” companies into the scope of regulation under the CSRC, and clarify that companies operating through a VIE structure in China can legally be listed abroad, after satisfying certain regulatory requirements.

- The new filing-based system specifies detailed filing requirements as well as “red lines” from the perspective of the CSRC’s supervision, including a new “negative list” that clearly enumerates the types of PRC companies (and offshore “red chip” companies) that are legally prohibited from participating in listings abroad.

- The Trial Measures ease certain restrictions on the types of entities that may issue securities abroad, as well as rules related to fundraising and the currency of dividends. Additionally, they seek to enhance the coverage of the CSRC’s regulations, allowing Chinese enterprises to raise, trade and spend RMB overseas, thus improving the international influence of RMB as well as the frequency of its appearance on a global regime.

- The Trial Measures will not apply retroactively (lex retro non agit). PRC companies seeking new listings/financings abroad will be required to comply with the Trial Measures in lieu of previously issued regulation, while companies that have already listed or applied for financings overseas will be afforded transitionary arrangements.

Legislative Framework of Trial Measures

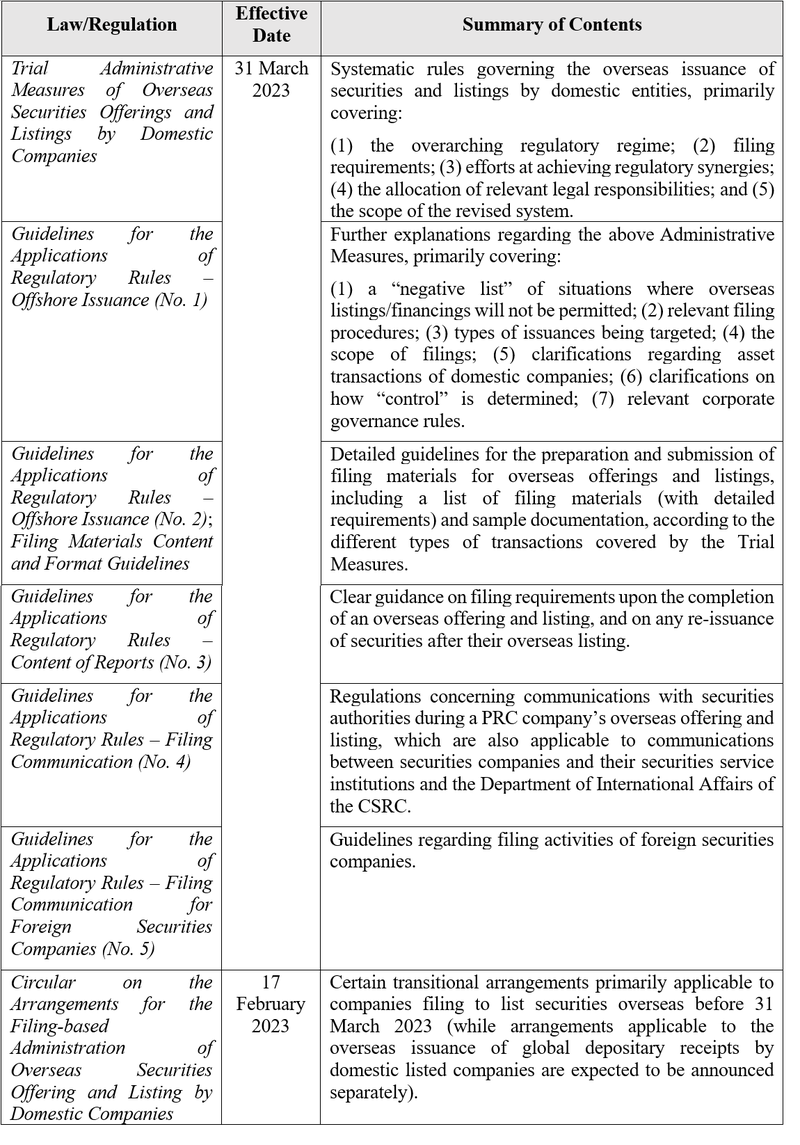

A high-level summary of each of the pieces of regulation or guidelines that comprise the Trial Measures is provided in the following table:

Filing Scenarios under Trial Measures

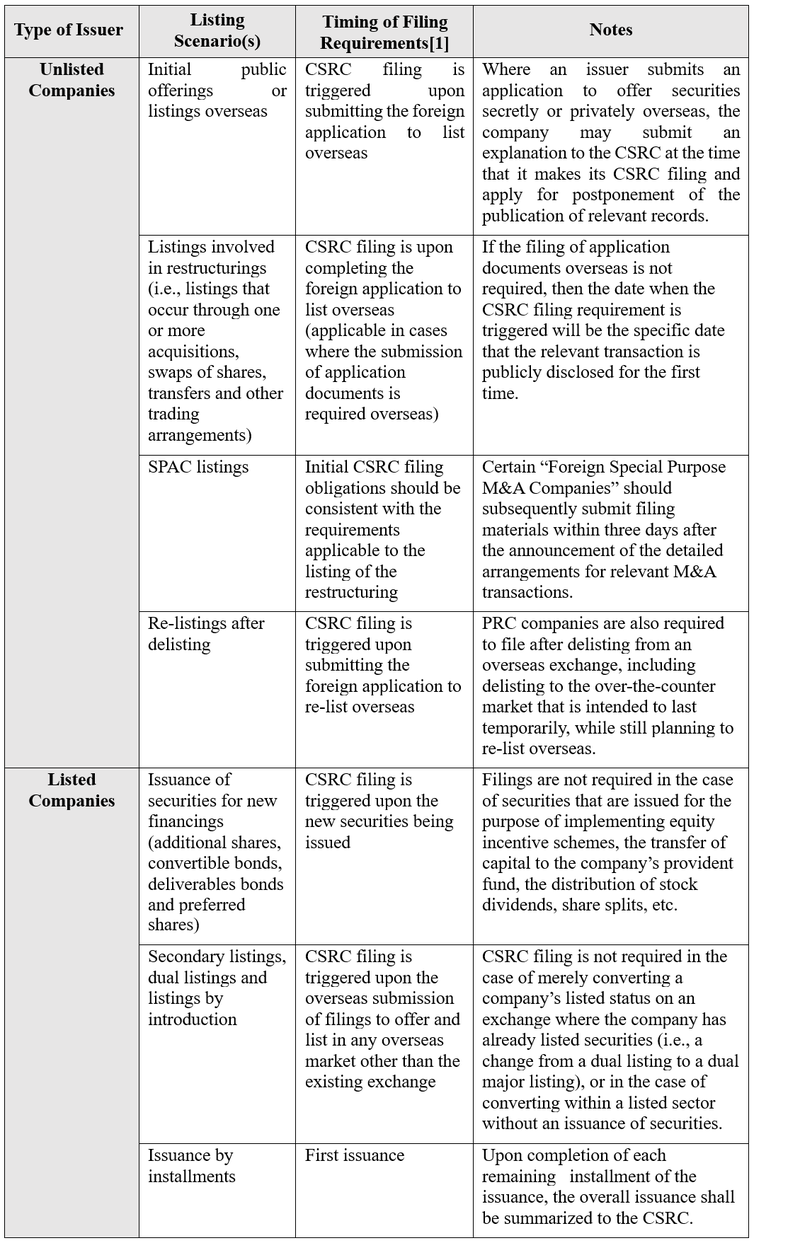

Among other things, the Trial Measures envision the following filing requirements, depending on the particular type of company submitting a filing and the particular category of listing/financing that such company seeks overseas:

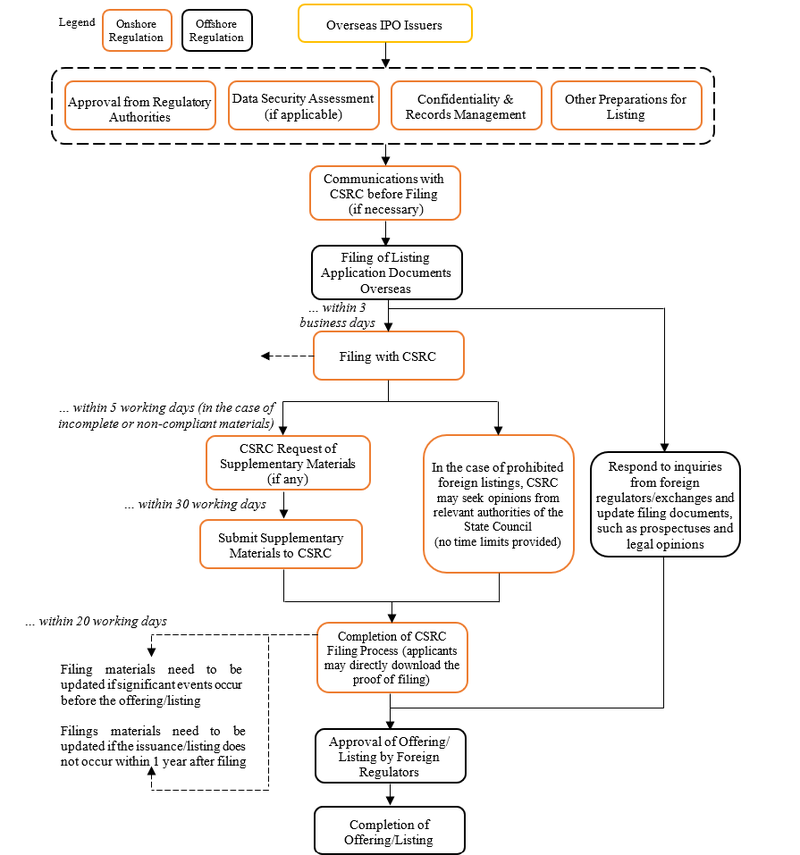

CSRC Filing Flowchart[2]

[1] Upon a CSRC filing requirement being triggered, the permitted time limit to complete such filing is within three business days.

[2] The diagram illustrates the standard procedures for a typical filing under an ordinary IPO process. Please note that upon the completion of the offering, applicants may still be required to either submit reports or make a new filing to the CSRC as a result of financing or other changes to the company.

Newsletter

Subscribe to our newsletter.

Related Services

Related Lawyers

Apr 19, 2025

DaHui Advises on Major Bio-Ethanol Deal in Vietnam, Combined Entity Expected to List on NASDAQ

Read Article